Roof Financing

Financing Options for Your Reroof Project: Making the Right Investment

Your roof is one of the most critical components of your home, providing shelter and protection. However, as roofs age, they can require repair or replacement, which can be a significant expense. If you’re facing a reroofing project and are concerned about the financial aspect, there are various financing options available to help you make the right investment in your home’s future.

1. Personal Savings:

Using your personal savings is the most straightforward way to finance a reroof project. If you have a substantial amount saved up, it’s a cost-effective way to complete the project without incurring interest or fees. However, it’s crucial to consider the impact on your overall financial stability.

2. Home Equity Loans:

Home equity loans, often known as a second mortgage, allow you to borrow against the equity in your home. These loans typically offer lower interest rates compared to unsecured loans or credit cards. They are a viable option if you have a significant amount of equity and can make fixed monthly payments.

3. Home Equity Lines of Credit (HELOC):

HELOCs work similarly to home equity loans but provide a revolving line of credit. You can borrow against the equity in your home as needed, making it a flexible financing option. Interest rates may be variable, so it’s essential to understand potential rate fluctuations.

4. Personal Loans:

Unsecured personal loans don’t require collateral, making them a convenient option for financing a reroof project. These loans typically have higher interest rates than secured options, so it’s important to compare rates and terms from various lenders.

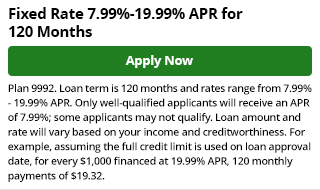

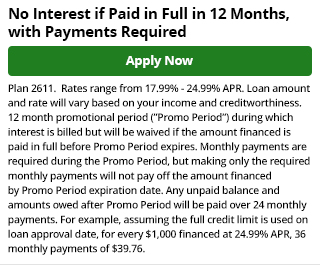

5. Roofing Company Financing:

Many roofing companies partner with financing providers to offer specialized financing options for reroof projects. These programs may have competitive interest rates and convenient repayment terms. It’s a convenient choice, as you can often apply for financing directly through the roofing contractor.

6. Credit Cards:

Using a credit card for a reroof project is a quick solution, but it’s essential to manage the high-interest rates associated with credit cards. If you choose this option, consider a card with a low introductory interest rate or a rewards program to offset some of the costs.

7. Government Assistance and Grants:

In some cases, government programs and grants may be available to assist homeowners in financing energy-efficient roof upgrades. These programs are often aimed at promoting sustainability and may offer financial incentives or tax benefits.

8. Insurance Claims:

If your roof requires replacement due to damage from a covered event, such as a storm or fire, your homeowner’s insurance may cover the cost of the replacement. Be sure to thoroughly review your policy and work with your insurer to navigate the claims process.

9. Crowdfunding and Community Support:

In some cases, homeowners have successfully turned to crowdfunding platforms or received support from their communities to finance reroof projects. Sharing your story and needs on platforms like GoFundMe or seeking help from local organizations can provide unexpected assistance.

10. 401(k) Loans:

While generally not recommended, some individuals opt to borrow from their retirement savings to finance home improvement projects. Be cautious with this approach, as it can have long-term financial implications, and it’s advisable to consult a financial advisor.

Before committing to any financing option, it’s crucial to assess your budget, credit score, and long-term financial goals. Carefully review the terms and conditions of each financing option, comparing interest rates, fees, and repayment terms. By making an informed decision about how to finance your reroof project, you can ensure that your home remains safe and secure while maintaining your financial stability.